Key Financials

FY2023 (31 December 2023), if not indicated otherwise

For detailed information, download the annual reports in our download center.

Guidance

The figures of the guidance 2024 and 2025 as mentioned below were calculated on the same basis as the actual figures for 2023.

2024 Revenue

€ 5.5 - 5.7 billion

taking into account the launches and the continued solid contributions from the existing product portfolio.

2024 adj. EBITDA

23.0% - 24.5%

reflecting investments in launches around the globe to offer potential new solutions for people living with severe diseases and the commitment to invest into research and development to advance the late-stage and early development pipeline.

2024 Core EPS

€ 3.70 - 4.40

based on an average of 190 million shares outstanding

2025 Revenue

at least € 6 billion

2025 adj. EBITDA

Low- to mid-thirties

2025 Improved ESG

rating performance

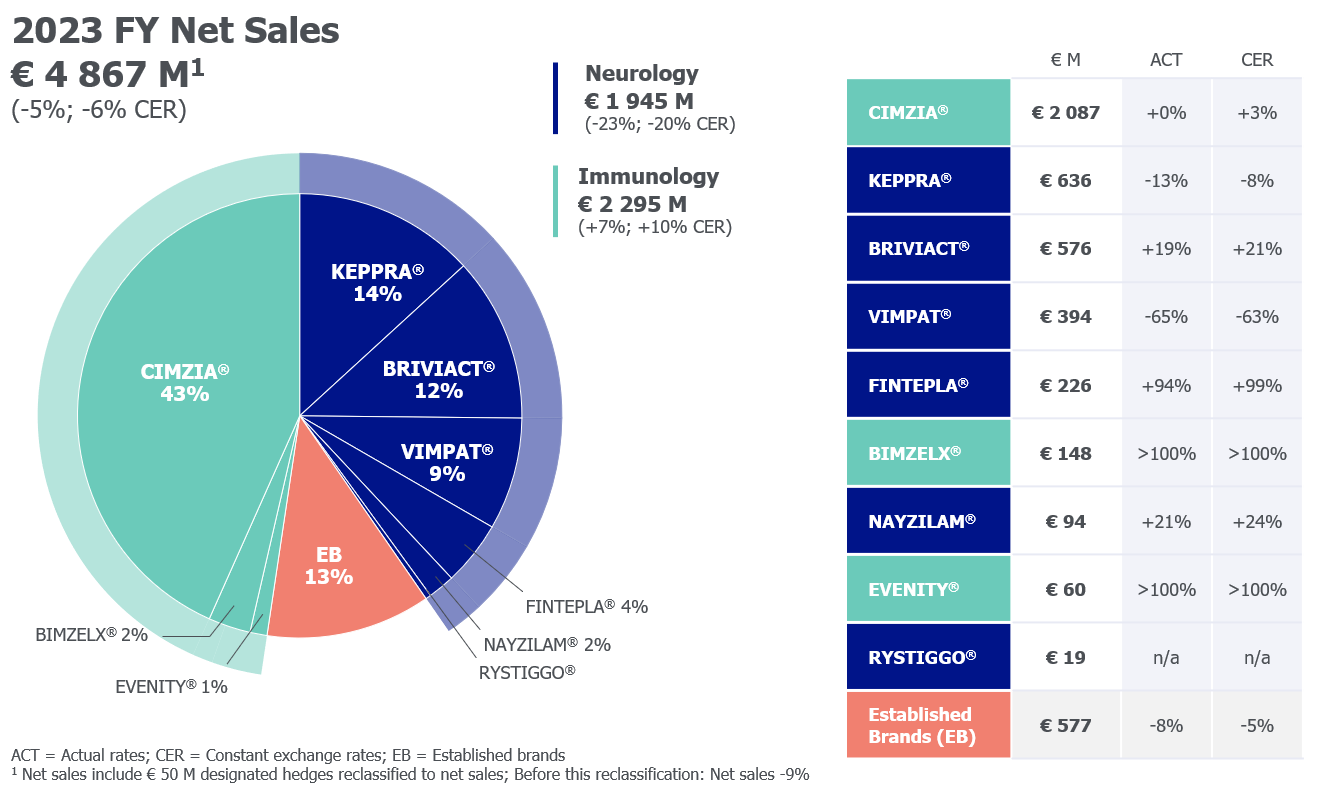

Product Sales

Strong underlying net sales growth thanks to a resilient product portfolio & new launches.

NAYZILAM® only available in the U.S., EVENITY® sales outside of Europe reported by Amgen and Astellas

CIMZIA®

peak sales guidance

≥ € 2 billion by 2024

achieved in 2022

BRIVIACT®

peak sales guidance

≥ € 600 million by 2026

FINTEPLA®

peak sales guidance

≥ € 800 million by 2027

BIMZELX®

peak sales guidance

> € 4 billion

Cash Flows

In 2023, the evolution of cash flow generated by bio-pharmaceutical activities was affected by the following:

- Cash flow from operating activities amounted to € 761 million compared to € 1 119 million in 2022. The cash inflow stems from underlying net profitability, offset with higher working capital mainly due to an increase in inventories and outstanding receivables.

- Cash flow from investing activities showed an outflow of € 440 million, compared to an outflow of € 1 580 million in 2022. The 2023 investing activities include mainly € 316 million capital expenditures, as well as € 113 million Contingent Value Rights to the former shareholders of Zogenix, Inc.

- Cash flow from financing activities had an outflow of € 308 million, which includes mainly the proceeds of the € 300 million retail bond offset by the reimbursement of the retail bond maturing in October 2023 (€ -176 million), the dividend paid to UCB shareholders (€ -252 million) and interests paid (€ -144 million).

Debt Financing

Net financial debt as per end December 2023 was € 2 177 million, an increase of € 177 million compared to € 2 000 million as of end December 2022. The increase is related to the 2022 dividend, offset with the underlying net profitability. Cash decreased in 2023 with € 133 million due to the payment of CVRs to the former shareholders and bondholders of Zogenix, Inc. The net debt to adjusted EBITDA ratio for 2023 is 1.6.

UCB has established a Euro Medium Term Note (EMTN) Program for its long-term funding needs which enables UCB to issue unsecured bonds with a tenor of minimum 1 year within a € 5 billion program.

Debt financing

EMTN Prospectus Archive

UCB has access to diversified funding sources. Per 31 December 2023, outstanding bonds included:

- € 150 million EMTN Notes, due 2027

- € 500 million institutional bond, due 2028

- € 300 million retail bonds, due 2029

On 13 March 2024, UCB completed the placement with qualified institutional investors of € 500 million senior unsecured bonds with a coupon of 4.25% and a tenor of 6 years. The bonds have been issued under its € 5 billion EMTN Program on 20 March 2024.

In addition to these bonds, UCB entered into various loan agreements, including a bullet floating rate syndicated term loan maturing in 2025 in connection with the acquisition of Ra Pharmaceuticals, Inc, a bullet floating rate syndicated term loan maturing in 2027 in connection with the acquisition of Zogenix, Inc as well as various other bilateral loan agreements (including with the European Investment Bank, drawn in September 2023, and Schuldscheindarlehen transactions entered into in 2022 and 2023).

Debt Maturity Schedule as of 31 December 2023